Your Downloads

You may need to right-click the following links and select Save Link As to download the file to your computer

Here’s what you get when you join the Trading Systems Network

Core Trading Systems

The 3 best trading systems in the network will be kept easily accessible in the Core Trading Library files. These are the main systems you will want to learn inside and out. Once you have these systems mastered you can move on to check out the Systems Library to explore other systems created by the network.

Systems Library

No more buying one hyped trading system after another. You now have access to an ever growing library of quality trading systems. New systems are added perpetually as they are developed by the network. You have the option to join in the development of exsisting projects or you can start your own project. You choose how involved you want to be.

Monthly System Analysis

Never stop researching, this is the best way to make sure you are trading the very best systems at all times. Each month a new system will be introduced or one of the Core Systems will be updated and reviewed. This process is extremely time consuming and beyond the ability of each person to do individually. As a network though, the work can be done one time and shared with all.

Video Presentations

Trading rules and code are detailed in HD video presentations. This makes learning the code and the system rules much easier than just reading the text explanation. So not only do you get a complete tutorial of the rules, you also get a look over the shoulder as the reason for each line of code is explained in detail.

Forum

This is where the Network comes to life! You can talk about whatever you want in here but the main goal is to take trading ideas and turn them into tradable systems. You can watch, participate or initiate, it’s up to you. Trading Systems that are developed in the forum can then be promoted to the Systems Library once development is complete.

Chat

Stay in touch with other network members during the day. This is a quick way to check in during the day to see what’s going on. Traders can alert one another to big movers and trade signals. Talking to others that have the same positions you do can go a long way in overcoming the psychological aspect of trading. Maybe you just want to shoot the breeze, it’s up to you.

Meet the Network Moderator…

Current Core Trading Systems

The system statistics and graphs are based on the same set of data, risk and cost assumptions to keep them consistent and comparable. The same exact system rules and inputs where used for each market in the backtest.

Risk – 2% of equity risked per trade

System Inputs – Same parameters used on all markets

Slippage and commissions – $40

History – 10 years

Portfolio – AUD/USD, Corn, Cotton, EUR/USD, Feeder Cattle, Gold, Lumber, Lean Hogs, Natural Gas, Orange Juice, Palladium, RBOB Gasoline, Soybeans, Sugar, Silver, 10 year Treasury Note, U.S. Treasury Bonds and Wheat.

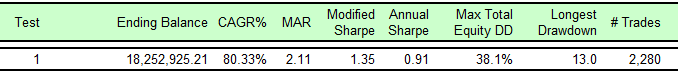

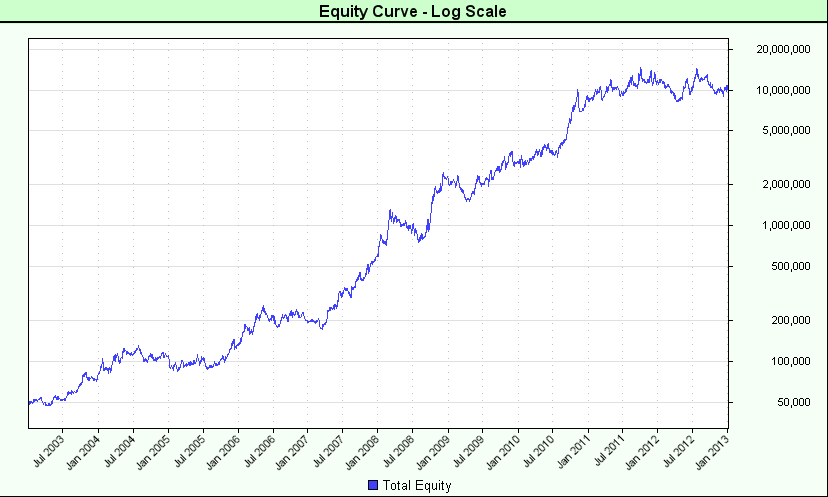

The Swing Machine measures the recent range of the market and enters trades when the range begins to expand. This approach attempts to keep the system flat during choppy non-directional periods and only enters a new position when the market is on the move. As you can see from the system report, it does a good job of capturing gains and avoiding losses.

Swing Machine Equity Curve

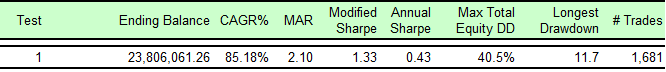

A unique system that combines support and resistance style trading with range expansion. Nothings more frustrating than buying the highs and selling the lows of a move. When trading the big breakouts it happens too often yet the risk/reward remains favorable. To minimize those false breakouts and reduce drawdowns the Hi-Lo Trend system was created. It does a great job of eliminating many of the false breakouts while still allowing the big winners. It performed beautifully during 2008 when the markets made wild swings whipsawing many good systems with losses for the year.

Hi-Lo Equity Curve

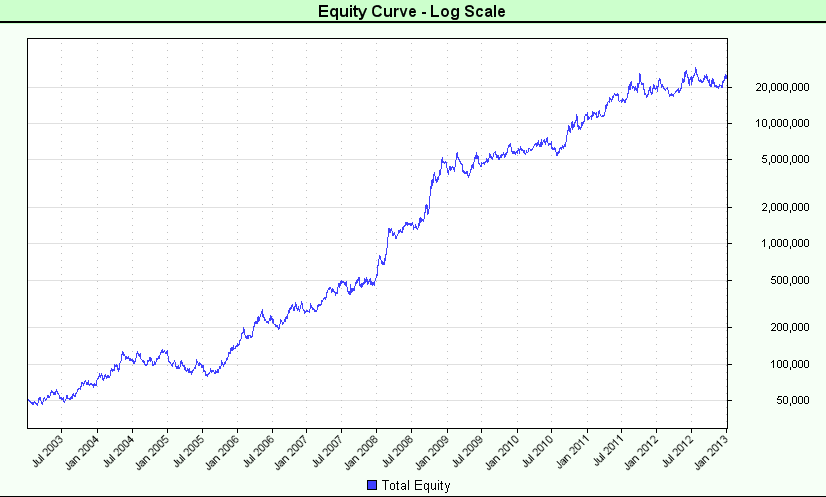

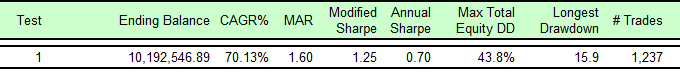

Consistently a Futures Truth Top 10 System based on 4 years of real-time performance. The performance is as strong today as ever and the system inputs have never been changed. At the heart of those returns is a trend filter to keep trades in the right direction and an exit that quickly reduces risk.

Update: Futures Truth just named Trend Weaver a Top 10 Most Consistent Trading System

Trend Weaver Equity Curve

Note: All code is fully open. Video explanations walk you through the exact rules for each of these systems while detailing the logic of the rules. Code is provided for the above systems to run with Trade Station, Trading Blox and Traders Studio.

Each of the core systems reports is based on a group of 18 commodities. You can of course trade it with more or less markets to match your account. Each of those systems could be applied to an individual market as well.

The reason I chose to show you a basket of markets is to prove that I’m not playing tricks with the numbers. By using a large sample of diversified markets, applying only one set of inputs per system and a position sizing formula to produce equal weighting from each market, the systems are forced to stand on their own. They either work or they don’t!

The other point I wanted to make is each of these systems was able to produce huge returns while maintaining a reasonable drawdown. We each have our own tolerance for the amount of pain we can handle during a drawdown. This forces each of us to choose where to set the risk dial before trading a system. For each of the examples above I tried to keep the risk close to 1/3.

Why a Trading Network

Everything I know about trading and trading systems I learned from others! Sure, I still had to figure out what works and what doesn’t but it’s the trading ideas and approaches to systematic trading that propelled me down the road to profitable trading. Take Trend Weaver for example, the Futures Truth Top 10 Most Consistent system I showed you the results for, I didn’t come up with that entirely on my own!

The trend identifier for Trend Weaver was something I stumbled on in the mid 90’s while working as a commodity broker. I worked for a small broker in Dallas Texas with four other guys. I was really into TradeStation at that time which was the platform we all used in the office. The other guys only used the software for quotes and charts so I was the only one in the office that used the backtesting Power Editor built into TradeStation.

I was a terrible broker, I spent all my time backtesting trading systems and trading my own account. This didn’t go unnoticed by the other brokers – they were always asking me to test something for them or one of their clients. I had already been using TradeStation for a year before working there so I was already fast at creating new code. Someone could tell me a system just one time and I could write out the code in a matter of minutes in most cases.

Although I had testing hundreds and hundreds of systems by this time, I still had not really found the kind of systems I had hoped to. Some of my systems worked okay but often with larger draw-downs than I wanted or erratic equity curves.

One of the brokers, Jeff, came to me one day just as he was leaving the office for the day and said “I had a conversation with an old trader a while back and he said something to me that I can’t stop thinking about”. He went on to tell me about the sales call with the old man who very kindly told him that he had been trading for many decades and wasn’t looking to move his account.

He liked Jeff though because he wasn’t the typical pushy salesman type and he said to him “Jeff, when it comes to trading, figure out the trend first, and only then think about where to enter the market”. He went on to give Jeff a really simple trading system that first identified the trend and then where to enter and exit the market.

Jeff started off by telling me the simple rule to identify the trend. He then tried to recall the entry rule and started to stumble. After several attempts, he just couldn’t seem to remember so I repeated back the trend filter he had already described and he said “yes, that part I’m sure of, I remember that part clearly, it’s the rest of it I didn’t really understand”.

Curious, I asked Jeff why he hadn’t asked me about this after talking to the old man when it was fresh in his memory. He told me the conversation took place before I started working there and besides “I never really thought trading systems worked until I saw you programming them – now I wonder if the old man actually given me something of value”.

I told Jeff I would work on his system that evening, I would just have to create some entry and exit rules to complete the system. I started by coding the trend filter (which was an aspect of trading systems I had not yet tried) – it took a little longer than the typical trading systems I had worked on up to this point because it was a condition for allowing a trade rather than a standard entry or exit rule. I just hadn’t thought of doing that before. After getting the filter to work I combined it with one of my favorite systems at that time, and boom… the missing piece to my trading systems fell into place – just that fast!

The draw-downs in my systems were reduced and the equity curves smoothed out – risk-adjusted returns improved across the board – just by adding a simple trend filter!

The old man taught Jeff and I an important lesson with just one short phone conversation. I don’t think calling it a lesson even begins to explain it because it forever changed the way I look at trading. It’s the basis for one of the most successful trading systems commercially available today – Trend weaver.

Over the years I have tested many different trend filters but none are more effective than the very first one I learned all those years ago from Jeff, who learned it from an old man in a short 5 minute phone call.

And that my friend is why I believe the Trading Systems Network is so important and needed. These little nuggets of gold (information) we collect along the way can either die in our memories or we can come together and share them with each other.

My motivation to create the site was not only to share what I have learned over the years, I also wanted to learn from traders like you! And sure enough, several traders, much like the old man, have stepped forward to share what they have learned in the Network and opened my eyes to new possibilities.

I’ve spent so many years programming, testing and trading in isolation than my focus started to narrow too much. I knew I needed to expand my tool chest of trading tools but had no desire to go back to reading worthless book after book or hyped websites. I wanted actionable trading systems that could instantly be tested and evaluated. No wasted time and energy on stuff that doesn’t work.

There has never been a better time to be a trader. Computers and historical price data are easily obtained. Trading software to facilitate trading and research is easier to use than ever before. Commission costs and spreads are at the lowest they have ever been thanks to electronic trading.

You can open a trading account with a fraction of the cash needed just a few years ago. Micro FOREX lots and odd lot stock positions, combined with small transaction costs, you can literally start trading with a fraction of what it took just 10 years ago.

And now you have access to a network of traders, specific trading systems, money management and research that until now has only been available to professional traders. If you’re serious about taking the business of trading to the next level then join us in the Trading Systems Network today.

So what are you waiting for? Take action now and get access to the

Trading Systems Network for the low price of only $195!

$25 a month for continued updates if you choose

- Core Trading Systems – The 3 best trading systems created within the network. When a better trading systems is created it will replace the weakest of the core 3.

- Monthly System Analysis – Presented by the network admin or one of the network members. A new trading system will be presented or a core system will be updated. The Network can then go to work to see if we can improve the system and decide if it should become one of the core systems.

- Forum – Members can talk about whatever you want in here but the main goal is to develop trading ideas into tradable systems. This is where you will work with others to develop new systems and to maintain existing core trading systems. Camaraderie among fellow traders is the missing link for many individual traders and the reason why they are constantly looking for the latest hyped trading system.

- Chat – Stay in touch with other network members during the day. Like a virtual trading office to gain support and camaraderie of your fellow traders.

and then $25 a month for continued updates

Orders securely handled by PayPal

CFTC REQUIRED RISK DISCLOSURE

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING.

FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.